Summary of document history

The targets define the ambition of the work and create accountability for the improvements being sought under the Cross-Border Payments Roadmap.

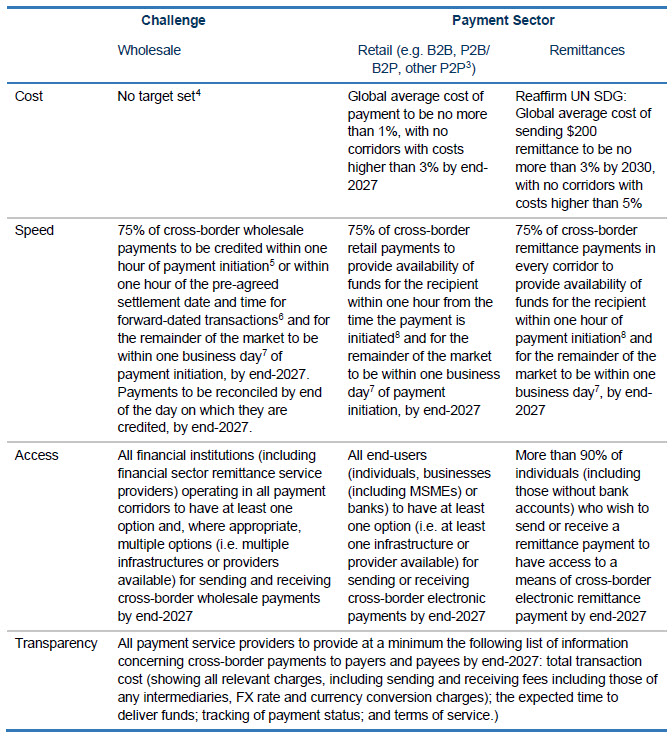

This report sets out global quantitative targets for addressing the challenges of cost, speed, transparency and access faced by cross-border payments. They play an important role in defining the ambition of the work of the G20 Roadmap for Enhancing Cross-border Payments, creating accountability. They have benefited from responses to a public consultation launched in May 2021.

The FSB has developed the targets based on the following principles. The targets should:

-

be directly related to the challenges

-

provide a clear indication of the extent of progress

-

be appropriately ambitious

-

be able to be readily communicated

-

be meaningful to the wide range of stakeholders.

The targets are based on a consideration of the current payment landscape and publicly available data from multiple sources for the four challenges across three market segments: wholesale; retail (e.g. business-to-business (B2B)/ person-to-business (P2B)/ business-to-person (B2P)/ person-to-person (P2P)) payments (other than remittances); and (as a separate category from other P2P payments) remittances.

End-2027 has been set as the common target date across the individual targets, with the exception of the remittance cost target, where a 2030 date has already been set as a United Nations Sustainable Development Goal (UN SDG) and endorsed by the G20. Stakeholders who are able to pursue faster implementation are encouraged to do so.

The full table of targets is shown below.

The FSB has developed proposals for an implementation approach for monitoring progress towards the targets that set out, in outline form:

-

how targets will be measured and data sources and data gaps to be filled;

-

how progress toward meeting the targets will be monitored; and

-

the frequency of data collection and publication.

By October 2022, the FSB will provide a report to the G20 and the public with further details of the implementation approach for progress monitoring, and with Key Performance Indicators (KPIs) providing estimates of current performance of cross-border payments in order to provide a baseline against which future progress toward the targets can be monitored. The October 2022 date for the report has been chosen to allow time for the approach to be developed with input from external stakeholders.

The FSB will publish an interim report in June 2022 on progress in developing the implementation approach.

Table 1: Targets for the Cross-Border Payments Roadmap