COVID-19 pandemic: Financial stability implications and policy measures taken – Report to the G20

This report, delivered to G20 Finance Ministers and Central Bank Governors for their virtual meeting on 18 July, assesses COVID-related financial stability developments, details policy measures taken and sets out work to assess their effectiveness.

Since the FSB last updated the G20 in April, financial markets have continued to recover from the COVID-19 shock on the back of this decisive policy action. While improving market sentiment has lifted risky asset prices, this may not fully reflect the fact that the pandemic continues and the path of recovery remains highly uncertain. As a result, risky assets remain vulnerable to shifts in the economic outlook.

The report notes that credit provision to the real economy has held up, but lenders face a challenging combination of deteriorating credit quality and rising credit demand. There has been a notable increase in bank lending to non-financial corporates. Capital markets – assisted by determined policy actions – have remained open and enabled firms to raise new and longer-term financing. However, virus containment measures, sharp reductions in supply capacity and falling commodity prices have led to a broad-based reduction in corporate earnings. This, together with relatively high levels of indebtedness and more relaxed underwriting standards in certain market segments in recent years, is weighing on credit quality.

The FSB Principles have guided national responses to COVID-19 to date. The international standards adopted through the G20 reforms have discouraged unilateral actions that would distort the level playing field and lead to market fragmentation. Most measures taken by FSB members to deal with the COVID-19 shock have used the flexibility available in international standards by design, including in the form of system-wide and firm-specific buffers. In a few cases individual temporary measures went beyond the flexibility of those standards, in order to respond to extreme financial conditions and provide operational flexibility to financial institutions.

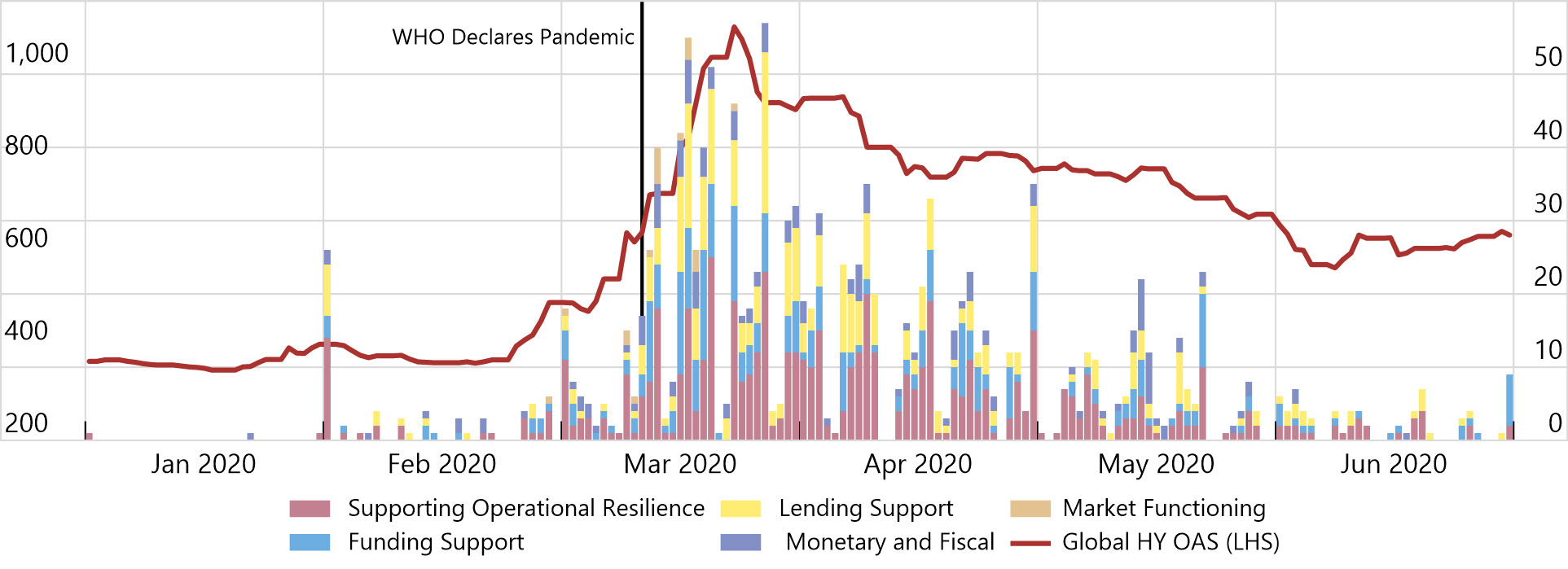

Policy measures taken in response to COVID-19: Number of policy submissions per day

The FSB continues to support international cooperation and coordination on the COVID-19 response underpinned by the FSB principles. The FSB is:

- Assessing financial risks and vulnerabilities – to support assessments of the appropriateness of financial policy responses and potential adjustments.

- Information sharing - regularly sharing information on policy responses and has begun supporting domestic assessments of the use of policy measures taken.

- Coordinating policy responses – the FSB has been coordinating the response to policy issues, including measures that standard-setting bodies (SSBs) may take to provide, or give guidance on, flexibility available to authorities and firms within existing international financial standards. The FSB and SSBs will also coordinate the future timely unwinding of the temporary measures taken as well as addressing any areas where existing policy frameworks have been found wanting.

- Considering the longer-term implications of the market turmoil in March - this will include a holistic post-mortem of what happened, drawing also on work by the SSBs.

The FSB will provide a further update on member authorities’ and SSBs’ COVID-19 responses, its financial stability risk assessment and its work on the effectiveness of policy responses by November 2020, ahead of the G20 Leaders’ Summit. The report was delivered to G20 Finance Ministers and Central Bank Governors together with a letter from the FSB Chair, Randal K. Quarles.