Press enquiries:

+41 61 280 8138

[email protected]

Ref no: 47/2020

The Financial Stability Board (FSB) today published its 2020 report on the implementation and effects of the G20 financial regulatory reforms.

The report, which will be delivered to G20 Leaders ahead of their Summit next week, finds that the G20 reforms after the 2008 financial crisis have served the financial system well during the COVID-19 pandemic. Greater resilience of major banks at the core of the financial system has allowed the system largely to absorb, rather than amplify, the macroeconomic shock. Bold and decisive actions by authorities sustained the supply of credit to the real economy and helped maintain global financial stability.

Given the pandemic, there has been limited additional progress implementing the G20 reforms during the last year. Regulatory adoption of several core Basel III elements has generally been timely to date, but there have been delays in implementing other Basel III standards. Substantial work remains to operationalise resolution planning for systemically important banks and to implement effective resolution regimes for insurers and central counterparties.

The FSB and standard-setting bodies (SSBs) have extended implementation deadlines for certain international reforms to provide additional capacity for firms and authorities to respond to the COVID-19 shock. In addition, authorities in many jurisdictions have taken regulatory and supervisory measures to alleviate the economic impact of COVID-19 on the financial system.

The pandemic represents the first major global test of the post-crisis financial system, and an opportunity to examine whether reforms have worked as intended. The FSB and SSBs will carry out further work to identify potential lessons learned for international standards.

Furthermore, the COVID experience has demonstrated once again how interconnected the global financial system is. close international cooperation is critical given the uncertainty about the pandemic, and necessary for the full, timely and consistent implementation of the reforms, which will help to further strengthen the resilience of the financial system. The FSB and SSBs will continue to promote approaches to deepen international cooperation, coordination and information sharing, with the support of the G20.

Notes to editors

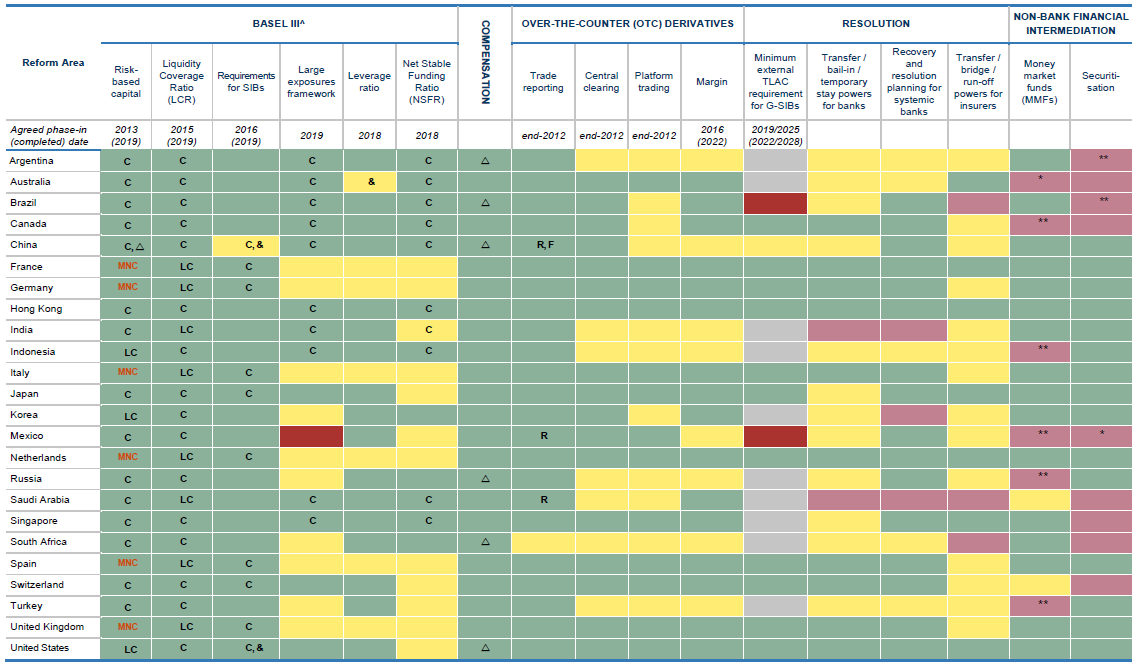

This report includes an implementation dashboard that summarises, in a colour-coded table, the status of implementation across FSB jurisdictions for priority reform areas. The report also presents the main findings of the FSB consultative report on the evaluation on the effects of too-big-to-fail reforms for systemically important banks.

The FSB coordinates at the international level the work of national financial authorities and international standard-setting bodies and develops and promotes the implementation of effective regulatory, supervisory, and other financial sector policies in the interest of financial stability. It brings together national authorities responsible for financial stability in 24 countries and jurisdictions, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. The FSB also conducts outreach with approximately 70 other jurisdictions through its six Regional Consultative Groups.

The FSB is chaired by Randal K. Quarles, Vice Chairman, US Federal Reserve; its Vice Chair is Klaas Knot, President of De Nederlandsche Bank. The FSB Secretariat is located in Basel, Switzerland, and hosted by the Bank for International Settlements.