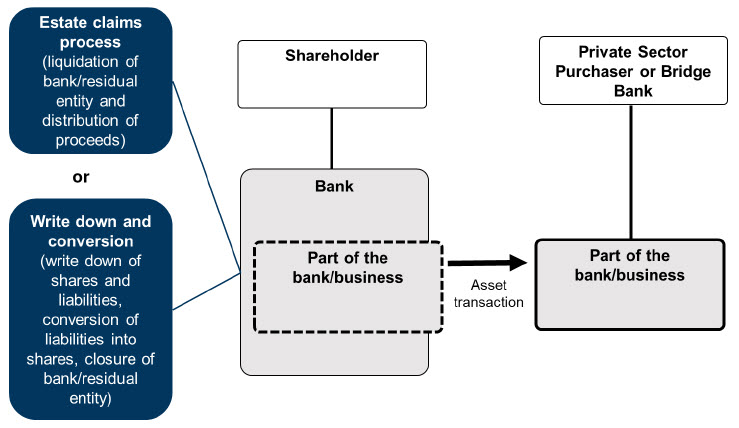

Transfer tools are an important component of the FSB’s Key Attributes of Effective Resolution Regimes. They ensure the continuity of critical functions by transferring parts – or all – of a failed bank to a private-sector purchaser or a bridge entity, while ensuring that losses are absorbed by shareholders and creditors rather than taxpayers. The 2023 banking turmoil showed how these tools can provide authorities with more options in a crisis.

The paper sets out how authorities operationalise whole-bank and partial transfers, starting with the definition of the transfer perimeter. It outlines arrangements for operational continuity, such as transitional service agreements and management of third‑party contracts, and approaches to marketing the transfer perimeter under tight timelines and confidentiality. The paper explains how loss absorption, in line with the creditor hierarchy, is ensured via write-down and conversion or an estate claims process liquidating the residual entity.

The paper describes the establishment and operation of bridge entities and highlights key challenges for cross-border execution of transfer tools. The case studies included in this paper illustrate some of the operational topics and practices to enhance preparedness to deploy transfer tools effectively.