This is the fifth annual report on the implementation and effects of the G20 financial regulatory reforms.

The report, which was delivered to the G20 meeting in October, sets out that implementation of the reforms called for by the G20 after the global financial crisis is progressing. This is contributing to an open and resilient financial system that supports the efficient provision of financing to the real economy.

Yet it is critical to maintain momentum and avoid complacency, in order to fully achieve the goal of greater resilience as vulnerabilities are evolving. Rapid structural and technological change require continued vigilance to maintain a sound and efficient financial system.

An open and resilient financial system, grounded in agreed international standards, is crucial to support sustainable growth. It requires the support of the G20 in implementing the agreed reforms and reinforcing global regulatory cooperation.

The report in particular recommends that:

-

Regulatory and supervisory bodies should lead by example in promoting the timely, full and consistent implementation of remaining reforms. This will support a level playing field and avoid regulatory arbitrage.

-

Frameworks for cross-border cooperation between authorities should also be enhanced in order to build trust, allow the sharing of information, and preserve an open and integrated global financial system.

-

Authorities should evaluate whether the reforms are achieving their intended outcomes, identify any material unintended consequences, and address these without compromising on the objectives of those reforms.

Financial stability authorities should continue to contribute to the FSB’s monitoring of emerging risks and stand ready to act if such risks materialise.

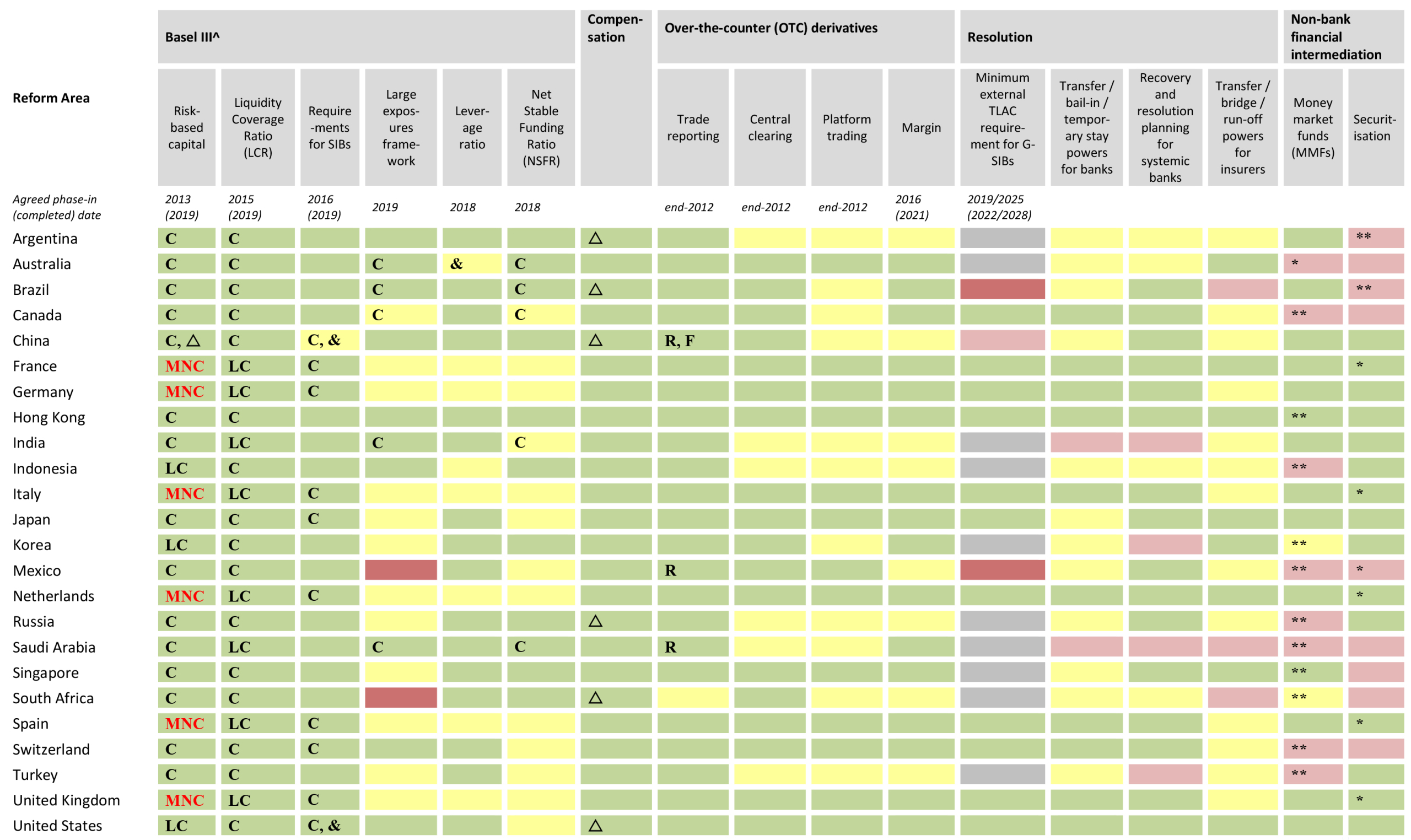

The report includes a colour-coded dashboard that summarises the status of implementation across FSB jurisdictions for priority reform areas.

Click the image to see in full-size.

Together with the report the FSB published annual survey responses by its member jurisdictions on implementation of other areas of reform together with summary tables and jurisdiction profiles on implementation progress. Taken together, these reports provide a holistic picture of the implementation of the G20 reforms.