Press enquiries:

+41 61 280 8138

[email protected]

Ref no: 36/2020

The Financial Stability Board (FSB) today published a letter from its Chair, Randal K. Quarles, to G20 Finance Ministers and Central Bank Governors ahead of their virtual meeting today.

The letter notes the extraordinary challenges for the global financial system this year. The FSB will provide a comprehensive report on the financial stability implications of, and policy responses to, the COVID Event to the November G20 Summit, including a holistic review of the market turmoil in March. The holistic review will inform future steps of the FSB in 2021 under the Italian G20 Presidency to improve the resiliency of the NBFI sector while preserving its benefits.

Meanwhile, the FSB has not lost sight of important ongoing work in financial innovation, payments systems, cyber resilience, and market fragmentation. The FSB is submitting to the G20 work addressing issues at the frontier of financial innovation and technology, including:

- a toolkit of effective practices that the FSB encourages regulators and financial institutions to use to respond to and recover from the negative impacts of a cyber incident;

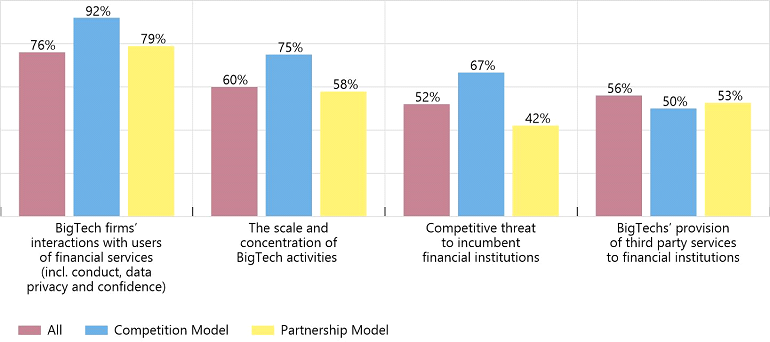

- an examination of the impact that BigTech firms have on emerging market and developing economies;

- an assessment of how SupTech and RegTech technologies may improve authorities’ supervisory capabilities and institutions’ regulatory compliance; and

- high-level recommendations for regulatory, supervisory, and oversight responses to so-called “stablecoin” instruments, by applying the lens of ‘same activity – same risk – same rules’.

This work aims to provide the regulatory community with additional tools to quickly assess and mitigate the risks posed by such changes without tempering the benefits. It also reflects the fundamental role international coordination plays in creating a resilient financial system that seeks to avoid harmful market fragmentation.

The letter also describes the FSB’s high-level roadmap for developing cross-border payment systems and processes that are faster, more inclusive, less expensive, and more transparent. While the actions that form the overall roadmap are ambitious they are achievable with the continued support from the G20.

In addition, the FSB continues is working on a variety of fronts to promote a resilient and integrated global financial system. The financial stability implications of climate-related risks remain a topic of great interest for the FSB’s membership and the international community. In addition, the FSB continues with other global standard-setting bodies in efforts to address market fragmentation.

The full list of reports delivered to today’s G20 meeting is as follows:

- FSB Chair’s letter to G20 Finance Ministers and Central Bank Governors

- Effective Practices for Cyber Incident Response and Recovery

- BigTech Firms in Finance in Emerging Market and Developing Economies – October 2020

- The Use of Supervisory and Regulatory Technology (SupTech and RegTech) by Authorities and Regulated Institutions

- Regulatory Issues in Regulation, Supervision and Oversight of “Global Stablecoin” Arrangements

- G20 Roadmap on Enhancing Cross-Border Payments

- Market Fragmentation: Updates on Ongoing Work

- FSB/IMF Fifth Progress Report on G20 Data Gaps Initiative (DGI-2)

Notes to editors

The FSB coordinates at the international level the work of national financial authorities and international standard-setting bodies and develops and promotes the implementation of effective regulatory, supervisory, and other financial sector policies in the interest of financial stability. It brings together national authorities responsible for financial stability in 24 countries and jurisdictions, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. The FSB also conducts outreach with approximately 70 other jurisdictions through its six Regional Consultative Groups.

The FSB is chaired by Randal K. Quarles, Vice Chairman, US Federal Reserve; its Vice Chair is Klaas Knot, President of De Nederlandsche Bank. The FSB Secretariat is located in Basel, Switzerland, and hosted by the Bank for International Settlements.