Press enquiries:

+41 61 280 8477

[email protected]

Ref: 20/2025

The Financial Stability Board (FSB), which plays a central role in safeguarding global financial stability, met on 18-19 November 2025 in Riyadh, Saudi Arabia. Members discussed vulnerabilities in the global financial system, challenges for emerging market and developing economies (EMDEs) and priorities for 2026, including additional work to support implementation. They also launched new initiatives related to modernising regulation and supervision, stablecoins, and nonbank financial intermediation (NBFI), and called for jurisdictional and regional action plans to promote improved cross-border payments.

Financial system vulnerabilities

Members discussed the challenging global economic outlook. The Plenary acknowledged the vital role of financial stability in supporting sustained growth. In this context, members discussed the evolution of financial system vulnerabilities since their June meeting, focusing on key risks and challenges. They highlighted historically stretched asset valuations, particularly in AI-related securities, and the potential for sharp market corrections. The possibility for borrowing conditions to tighten, especially for riskier companies, was also a concern given the uncertain global economic outlook. Rising levels of government debt worldwide, driven by factors such as slower economic growth, higher spending, and aging populations, could adversely affect financial resilience. Members noted that nonbank entities are increasingly important participants in the markets for government debt, but their use of highly leveraged trading strategies could amplify market volatility and instability, potentially across borders, in the event of a rapid unwinding of positions. The group also discussed risks specific to EMDEs, emphasising the particular challenges they face and the importance of continuing to address these risks effectively.

Plenary members also discussed private credit markets. While acknowledging that private markets are improving access to credit, members noted their rapid growth, complexity, relative lack of transparency, and growing connections to the banking sector and the rest of the financial system, which require careful monitoring to assess potential risks to financial stability.

The Plenary called for continued close monitoring of the growing interlinkages between crypto-assets and stablecoins and the broader financial system. Stablecoins may improve payment speed and efficiency, but they raise a number of vulnerabilities, including run risk and regulatory challenges associated with multi-jurisdiction issuers of stablecoins , which require continuing attention.

Members also noted that operational disruptions at key financial institutions or technology providers can potentially cause significant system-wide impacts.

FSB work programme

The Plenary approved the FSB’s work programme for 2026, including key deliverables for the United States G20 Presidency.

A number of jurisdictions are considering or have initiated efforts to modernise financial regulation and supervision in their jurisdictions. The Plenary agreed that the FSB should examine these initiatives to determine where it can support alignment of approaches globally.

Other areas of focus for 2026 include:

Crypto-assets and stablecoins

The FSB’s Thematic Peer Review of the FSB Global Regulatory Framework for Crypto-asset Activities, which was delivered to the G20 in October, highlighted the rapid growth of stablecoins and increasing interest from the traditional financial sector. The report also highlighted challenges related to regulatory fragmentation. Members emphasised the need for jurisdictions to align their regulatory frameworks, to prioritise financial stability, and to address anti-money laundering and countering the financing of terrorism concerns, as the crypto-asset sector continues to grow. In addition to vulnerabilities, members discussed the latest developments in stablecoins, including innovations, use cases, and policy responses, and considered work that the FSB should undertake on the financial stability implications of stablecoins, including laying the groundwork to address regulatory fragmentation and promote enhanced cooperation. Members noted the importance of coordination and collaboration across international organisations, standard-setting bodies and the Financial Action Task Force (FATF).

Implementation Monitoring Review

Plenary decided to move on to phase two of the strategic review of implementation led by Randal K. Quarles, the former Chair of the FSB.

Cross-border payments

The Plenary discussed progress on the G20 Roadmap for Enhancing Cross-Border Payments. The latest progress report, published in October, warned that the G20’s targets were unlikely to be met by the end-2027 deadline. Members called for jurisdictional and regional action plans to address specific challenges, including in EMDEs, and emphasised the need to continue to engage with the private sector to drive improvements.

Nonbank financial intermediation (NBFI)

The Plenary discussed the FSB’s work on enhancing the resilience of the NBFI sector. Members reviewed a report on vulnerabilities in government bond-backed repo markets and the links between the repo and government bond markets. The Plenary supported further work to promote implementation of the FSB’s recommendations on liquidity management by open-ended funds and on NBFI leverage. The latter includes work with the industry to enhance disclosure by nonbank entities to their prime broker counterparties. The Plenary noted the need for progress on addressing data gaps related to leveraged trading strategies in sovereign bond markets under the Nonbank Data Task Force.

Members also discussed options for work on private credit, including further assessment of vulnerabilities and interlinkages, as well as work on data gaps.

Resolution

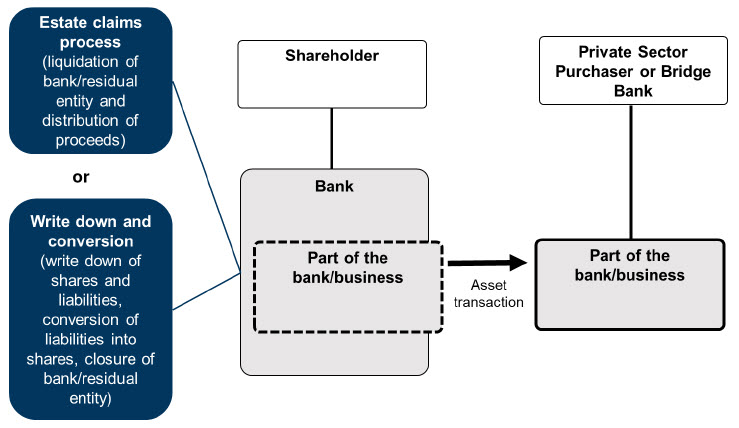

The 2023 banking turmoil underscored the need to coordinate across different authorities to strengthen crisis preparedness. Members considered a proposal for a strategic review of the FSB’s crisis preparedness activities and emphasised the importance of ensuring the FSB is able to lead efforts in this area effectively. Continuing efforts to improve implementation monitoring of resolution standards in all sectors will form the basis of the FSB’s work on resolution in 2026. For the banking sector, the Plenary noted that funding in resolution remains a challenge for the effective implementation of the FSB’s resolution framework. This issue, alongside enhancing the effectiveness of the execution of cross-border bail-in, will also be addressed in 2026.

Insurance

The Plenary welcomed the FSB’s experience utilising the International Association of Insurance Supervisors’ Holistic Framework assessments instead of an annual identification of global systemically important insurers. Members approved the publication of the annual list of insurers subject to resolution planning standards and a consultation report on recovery and resolution planning requirements for insurers.

Conclusion

Governor Andrew Bailey, Chair of the FSB, commented: “This Plenary marks a significant step for the FSB. Our members have agreed to focus the work of the FSB to respond to changes in the pattern of financial stability vulnerabilities, the adoption of innovation, and to ensure a stable financial environment to facilitate economic growth. Our 2026 agenda of work is demanding, but we remain committed to closely scrutinising vulnerabilities in the market and resolutely following up to ensure the implementation of our recommendations across the globe.”

Notes to editors

The FSB coordinates at the international level the work of national financial authorities and international standard-setting bodies and develops and promotes the implementation of effective regulatory, supervisory, and other financial sector policies in the interest of financial stability. It brings together national authorities responsible for financial stability in 24 countries and jurisdictions, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. The FSB also conducts outreach with approximately 70 other jurisdictions through its six Regional Consultative Groups.

The FSB is chaired by Andrew Bailey, Governor of the Bank of England. The FSB Secretariat is located in Basel, Switzerland and hosted by the Bank for International Settlements.