OTC Derivatives Market Reforms: Implementation progress in 2021

This report tracks international progress in finalising standards and national and regional progress in implementing the G20 reforms to global over-the-counter (OTC) derivatives markets reforms following the 2008 Global Financial Crisis.

Overall implementation of the G20’s OTC derivatives reforms was already well advanced by 2020, but there has been further incremental progress across FSB member jurisdictions since the previous annual report in October 2020.

-

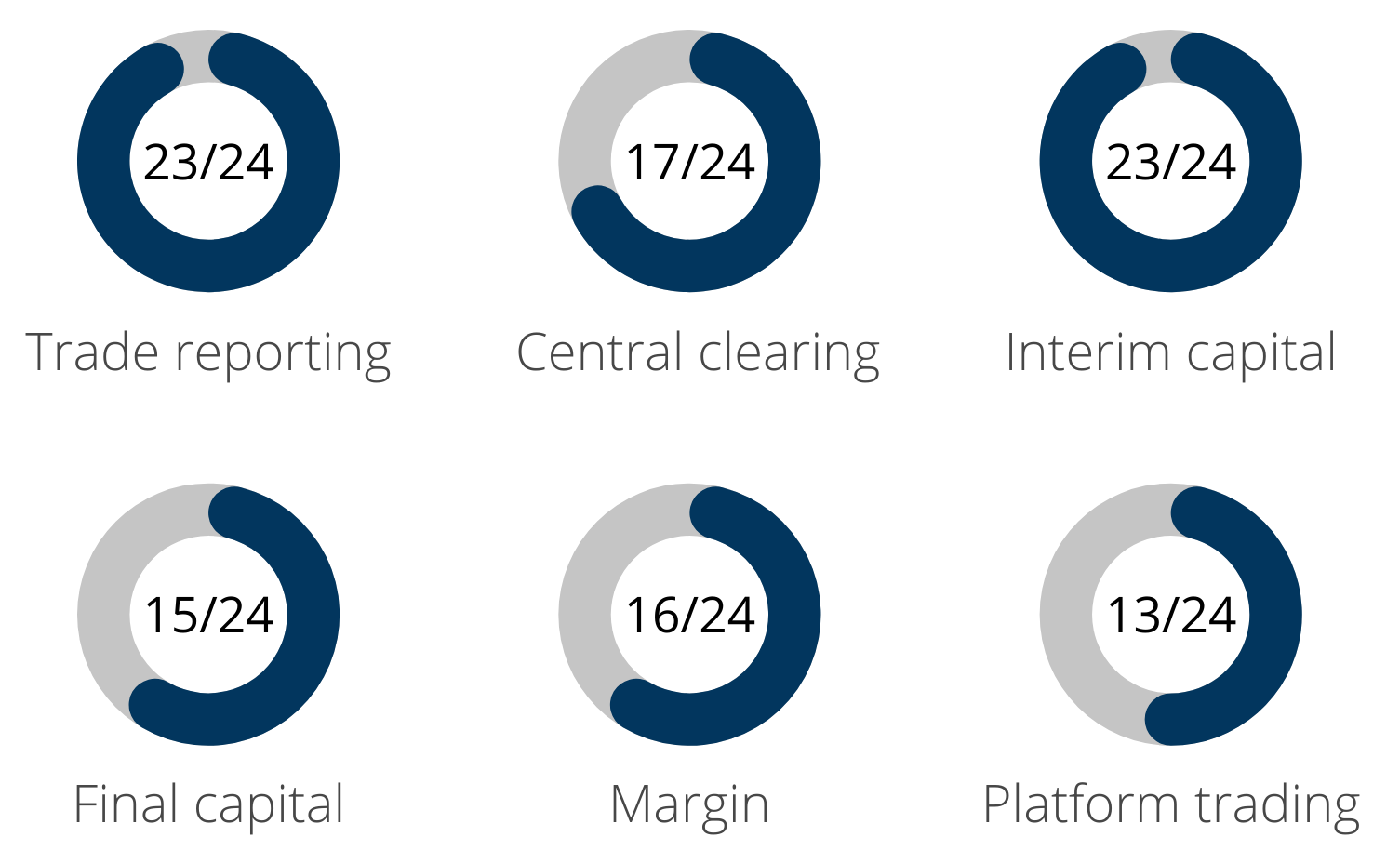

Capital requirements for non-centrally cleared derivatives (NCCDs): 15 out of 24 FSB member jurisdictions have higher capital requirements for NCCDs (significantly up from 8 in 2020). More jurisdictions are expected to implement these requirements in 2022.

-

Margin requirements for NCCDs: The number of jurisdictions where margin requirements are in force remains unchanged at 16. Two jurisdictions published draft standards. Some jurisdictions that have yet to implement the requirements expect to do so before the final implementation phase takes effect on 1 September 2022.

-

Trade reporting: The number of FSB jurisdictions where trade reporting requirements are in force remains unchanged at 23. In the remaining one jurisdiction, preparations for authorising a trade repository and implementing the jurisdiction’s requirements are ongoing. Some jurisdictions report they have further strengthened the functioning of trade repositories and the reporting requirements.

-

Central clearing: 17 FSB member jurisdictions have in force central clearing requirements, unchanged since the 2020 report. Some jurisdictions are taking steps toward implementation of mandatory central clearing, including authorisation of a central counterparty (CCP) in the jurisdiction.

-

Platform trading: The number of jurisdictions with platform trading requirements in force remains unchanged at 13.

Number of FSB jurisdictions in final implementation phase

Number of jurisdictions where legislation framework is in place and standards/requirements are in force for over 90% of transactions

The report also notes that most jurisdictions have withdrawn or have not extended measures previously introduced to alleviate the operational burden for OTC derivatives market participants in response to COVID-19. Changes to market and counterparty credit risk frameworks and margin practices to limit and mitigate excessive procyclicality have been embedded into jurisdictions’ supervisory frameworks.