Peer Review of Italy

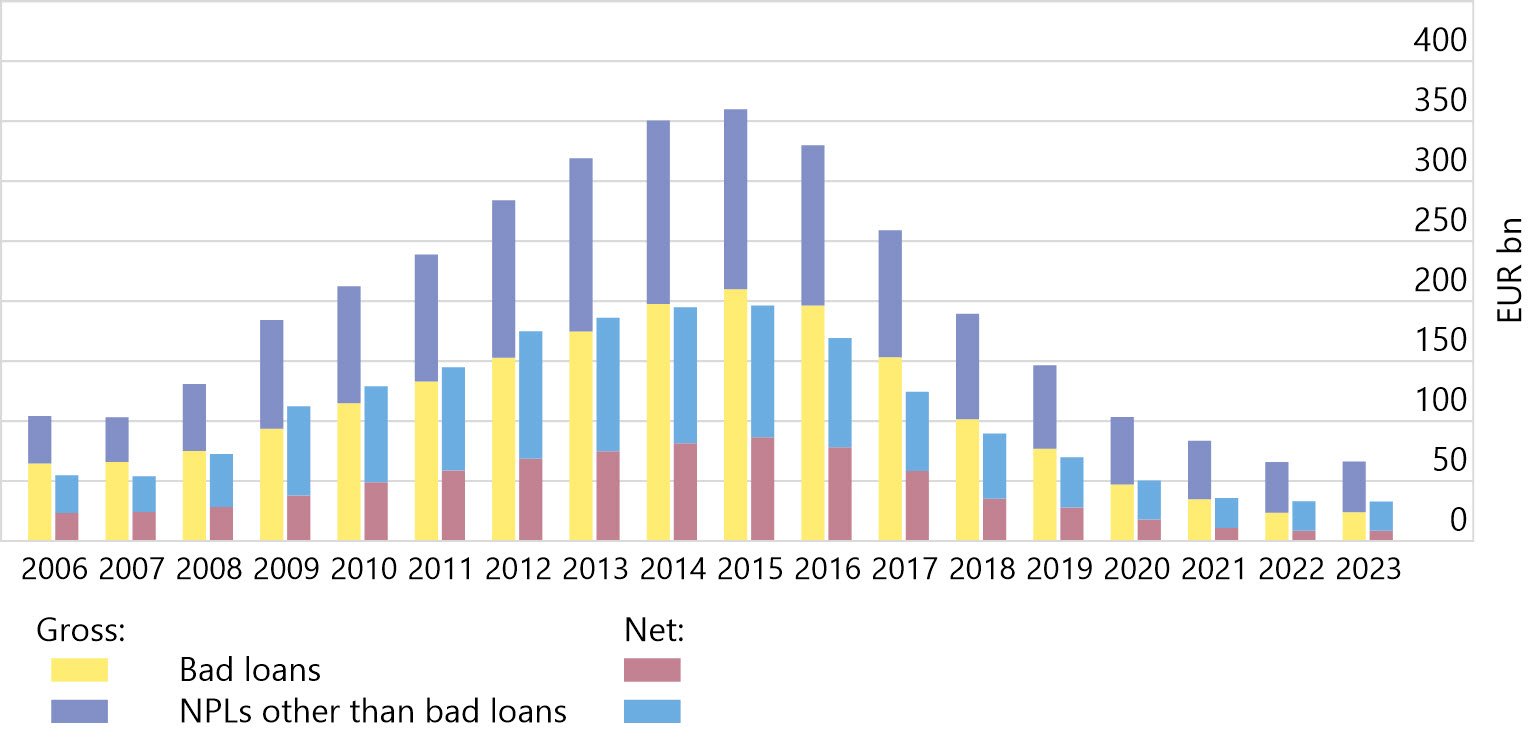

The Italian authorities have achieved significant success in reducing NPLs on bank balance sheets.

This peer review assesses Italy’s recent experience in reducing non-performing loans (NPLs) in the Italian banking sector, focusing on the following areas:

-

the accounting, regulatory and supervisory measures put in place to support the management of NPLs on banks’ balance sheets;

-

measures to facilitate a robust secondary market for the removal of NPLs from bank balance sheets, notably the Guarantee on securitisation of bank bad loans (GACS) mechanism; and

-

measures to improve the efficiency of the legal framework for enforcement, debt restructuring and insolvency.

It finds that Italian authorities have achieved significant success in reducing NPLs on bank balance sheets. Close cooperation between domestic authorities, open communication with the private sector and a collective responsiveness significantly contributed to this successful reduction.

The peer review report includes recommendations to the Italian authorities to preserve the success achieved and to continue to improve the ecosystem for managing NPLs, by fostering the secondary market for NPLs and monitoring closely and further improving the efficiency of the insolvency, debt restructuring and debt enforcement framework.