The Financial Stability Implications of Leverage in Non-Bank Financial Intermediation

Many incidents have demonstrated that leverage can create and amplify vulnerabilities in the global financial system.

Leverage is a financial technique used to increase exposure, boost returns or take positions that can offset potential losses from other exposures (hedging). If not properly managed, the build-up of leverage creates a vulnerability that, when acted upon by a shock, can propagate strains through the financial system, amplify stress and lead to systemic disruption. This has been demonstrated by a series of financial incidents, stretching back to the 1998 collapse of Long-Term Capital Management, the 2008 global financial crisis, the March 2020 market turmoil, the 2021 Archegos failure, and the September 2022 dislocation in the UK gilt market.

Building on the lessons from the turmoil, the FSB developed a comprehensive work programme to examine and address vulnerabilities, including those associated with NBFI leverage that contribute to systemic risk. This report forms part of that work by providing an overview of aggregate NBFI leverage trends across FSB jurisdictions.

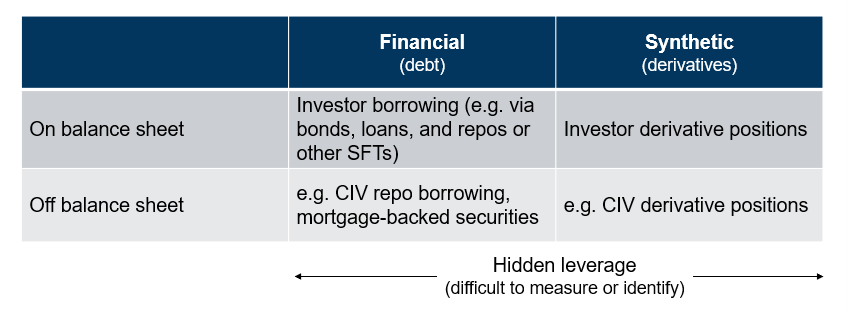

Illustration of different forms of leverage

The report also discusses the vulnerabilities associated with NBFI leverage, including propagation and amplification mechanisms; looks at aggregate trends in NBFI leverage through a set of metrics; discusses hedge fund leverage and the links with prime brokers; covers leverage, LDI strategies, and long-term investors; and describes the data gaps that lead to hidden leverage.

The report concludes with policy implications of the work that authorities could consider.