2022 TCFD Status Report: Task Force on Climate-related Financial Disclosures

In its 2022 status report, the Task Force analyses the current state of disclosure practices as well as progress in firms’ disclosures in line with the TCFD Recommendations over the past five years.

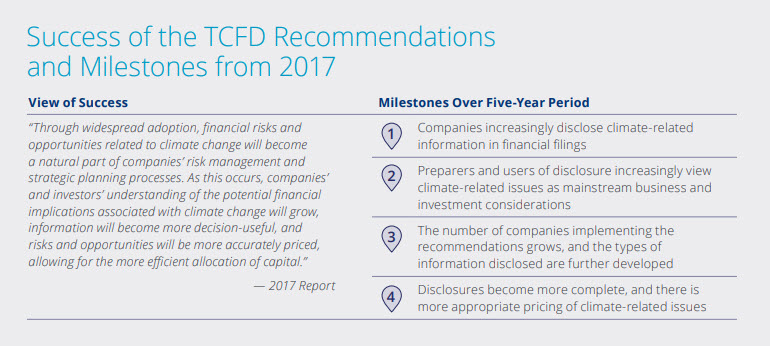

In June 2017, the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (Task Force or TCFD) released its Recommendations, which provide a framework for companies and other organizations to develop more effective climate-related financial disclosures through their existing reporting processes.

As with previous status reports, this report provides an overview of current disclosure practices in terms of their alignment with the Task Force’s Recommendations. It also highlights progress in firms making disclosures aligned with the TCFD Recommendations over the past five years—including progress relative to key milestones identified in 2017, implementation trends and challenges that may be useful for companies beginning to implement the recommendations, and investors and other users’ views on the usefulness of climate-related financial disclosures and improvements needed.

Overall, the report finds encouraging signs of progress in companies disclosing climate-related information but notes that more urgent progress is needed to improve transparency, especially when considered within the broader global focus on climate change.

More specifically, the report finds that:

-

The percentage of companies disclosing TCFD-aligned information continues to grow, but more urgent progress is needed. For fiscal year 2021 reporting, 80% of companies disclosed in line with at least one of the 11 recommended disclosures; however, only 4% disclosed in line with all 11 recommended disclosures and only around 40% disclosed in line with at least five.

-

All regions have significantly increased their levels of disclosure over the past three years. Europe remains the leading region for disclosure at 60% on average across the 11 recommended disclosures, 24% higher than the next highest region (Asia Pacific). There has been encouraging growth in other regions. The average level of disclosure in North America, for example, grew by 12 percentage points, between 2019 and 2021, to 29% for North America.

-

Reporting on climate-related risks and opportunities (Strategy a in the TCFD recommendations) is higher than any other recommended disclosure. Just over 60% of companies reviewed including such information in their 2021 fiscal year reports.

-

Reporting on risk management processes is below average but steadily improving, shown strong growth compared to the other recommended disclosures. For 2021 reporting, the level of disclosure on processes for identifying and assessing climate-related risks (Risk Management a in the TCFD recommendations) was 33%; processes for managing climate-related risks (Risk Management b) was 34%; and whether processes are integrated into overall risk management (Risk Management c) was 37%.

-

Disclosure of the resilience of companies’ strategies under different climate-related scenarios (Strategy c in the TCFD recommendations), continues to have the lowest level of disclosure across the 11 recommended disclosures, at 16%.

-

Governance remains the least disclosed recommendation. The two Governance recommended disclosures were the second and third least disclosed of the Task Force’s 11 recommended disclosures.

-

Several industries now have average levels of disclosure of over 40%. For fiscal year 2021 reporting, industries with average disclosure levels across the 11 recommended disclosures of more than 40% include energy companies (43%), materials and buildings companies (42%), banks (41%), and insurance companies (41%).

Source: TCFD

More than 3,800 organisations have become supporters of the TCFD Recommendations, a number which has steadily increased since the Recommendations we er first published. These supporters include over 1,500 financial institutions, responsible for assets of $217 trillion. TCFD supporters now span 99 countries and nearly all sectors of the economy, with a combined market capitalisation of over $26 trillion.

The FSB recognises the continuing need to maintain momentum by monitoring and reporting on progress in firms’ climate disclosures, during the period until the International Sustainability Standards Board (ISSB)’s global baseline standard is agreed and the implementation of that standard across jurisdictions begins to be monitored. The FSB has, therefore, asked the TCFD to publish a further status report in 2023, reviewing disclosures by companies in their public reporting for 2022.