RCG for the Americas: Non-Bank Financial Intermediation Monitoring - Sixth Report

Since December 2012, the FSB Regional Consultative Group for the Americas has conducted a regional monitoring exercise of the non-bank financial intermediaries sector within its member jurisdictions.

This report presents the results of the sixth non-bank financial intermediation (NBFI) monitoring exercise in the Americas. The exercise assesses the size, structure and recent trends of the NBFI sector in the region. The impact of the COVID-19 underlined the importance of this information in identifying potential risks to financial stability at the jurisdiction level, as well as those arising from potential cross-border linkages.

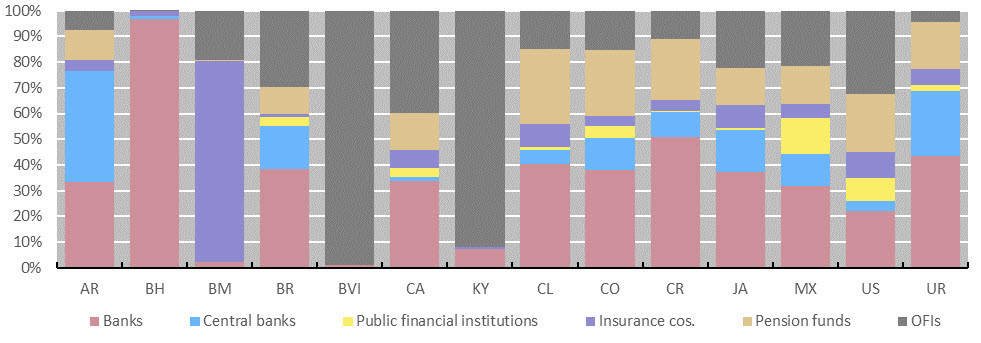

The report concludes that total financial assets in the region reached over $140trn at end-2019, with growth of 10.1% during 2019, faster than the annualised growth of 3.6% for the period between 2013 and 2018 and contrasting with the negligible annual contraction of 0.2% registered during 2018. The growth in total assets in 2019 was largely driven by the largest jurisdiction (United States), but growth was positive also in most other jurisdictions in the region.

The narrow measure, which covers NBFI activities that may pose bank-like financial stability risks, reached $27.7trn at end-2019, up from $24.4trn at end-2018, a faster growth rate (13.7%) than that observed in previous years (the compound growth rate for the 2013- 2018 period was 3.7%). Within the narrow measure, the fastest growth was in collective investment vehicles with features that make them susceptible to runs, which grew by 17.1% in 2019 and made up 76.2% of the narrow measure at end-2019.

This document has been prepared by the FSB RCG for the Americas and is being published to disseminate information to the public. The views expressed in the document are those of the RCG for the Americas and do not necessarily reflect those of the FSB.