Stocktake of financial authorities’ experience in including physical and transition climate risks as part of their financial stability monitoring

This stocktake considers financial authorities’ experience of including climate-related risks in financial stability monitoring. It draws on information provided by FSB members, international bodies and a workshop with the private sector.

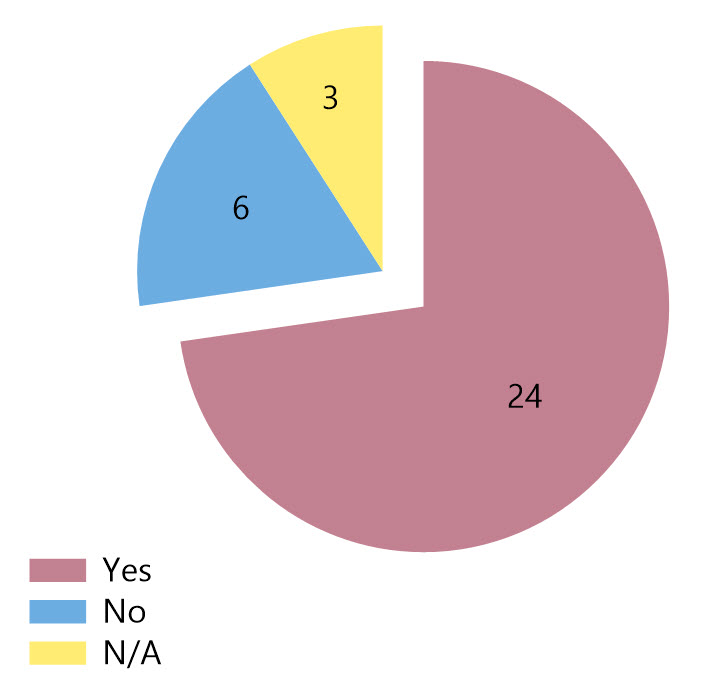

The stocktake finds that financial authorities vary in terms of whether – and to what degree – they consider climate-related risks as part of their financial stability monitoring. Around three-quarters of survey respondents consider, or are planning to consider, climate-related risks as part of their financial stability monitoring. Most focus on the implications of changes in asset prices and credit quality. A minority of authorities also consider the implications for underwriting, legal, liability and operational risks.

Inclusion of climate-related risks in their financial stability monitoring : Do you consider risks from climate change as part of your financial stability monitoring?

Authorities also consider the implications of these risks for financial institutions. Consideration of climate-related credit and market risks faced by banks and insurers appears more advanced than that of other risks, or of risks faced by other types of financial institutions. Some financial authorities have quantified, – or have work underway to quantify – climate-related risks. Such work is hindered by a lack of consistent data on financial exposures to climate risks and difficulties translating climate change outcomes into changes in those exposures. No approach to quantification provides a holistic assessment of climate-related risks to the global financial system.

In some jurisdictions, climate-related risks are being integrated into microprudential supervision of banks and insurance firms (including via requirements for firms’ stress testing and disclosure). However, such work is generally at an early stage. Some authorities report having set out – or being in the process of setting out – their expectations as to firms’ disclosure of climate-related risks. In some cases such expectations explicitly refer to the recommendations of the FSB’s Task Force on Climate-related Financial Disclosures.

The stocktake draws on takeaways from discussions with the private sector. At a workshop market participants said that climate-related risks were significant and had the potential to impact their businesses. However, they said it is unclear whether – and to what degree – financial market prices incorporate climate-related risks. The workshop included discussion of the channels through which climate-related risks to the financial system may affect the real economy, and, in turn, have further effects on the financial system.

The FSB will conduct further work by October 2020 to assess the channels through which physical and transition risks could impact the financial system and how they might interact. Particular focus will be given to the potential amplification mechanisms and cross-border effects, and to prioritising channels that could materialise in the short-to-medium term. The FSB will also consider the scope for work to assess available data through which climate-related risks can be monitored, as well as any data gaps. This work will build upon, and be coordinated with, that taking place in other relevant international fora.